Challenge Accepted

When experienced independent contractors are told that "nobody can start a small business with $5,000," we think, "Sure you can."

I was stunned this past weekend as I listened to Vice President Kamala Harris’ sit-down interview with Philadelphia’s ABC News affiliate.

In the interview, Harris says—as if it’s a cold, hard fact—that “nobody can start a small business with $5,000.”

Watch for yourself, starting at about 2:30:

It is disconcerting, to say the least, that anyone within a hundred miles of labor, employment and business policymaking believes that nobody can start a small business with $5,000.

And it yet again clearly shows that people who support freelance busting, including Vice President Harris, simply don’t comprehend how countless small businesses operate here in the United States of America.

Of course you can start a small business for $5,000.

Thanks to today’s technology, you can actually start one for less than that.

Many independent contractors have already done it. We need lawmakers on both sides of the aisle who understand us, and support us, with their policymaking.

What Is a Small Business?

When politicians want to let cameras capture them “supporting small businesses,” they head to Main Street in Anywhere USA and buy something from a storefront location, like a doughnut shop.

It’s campaign season, so there’s a lot of this going around right now:

The thing is, while those Main Street shops may be the most visible small businesses in the United States, they are not the majority of them.

Far from it.

If politicians wanted to interact with most of America’s small-business owners right now, they’d have to show up at our homes.

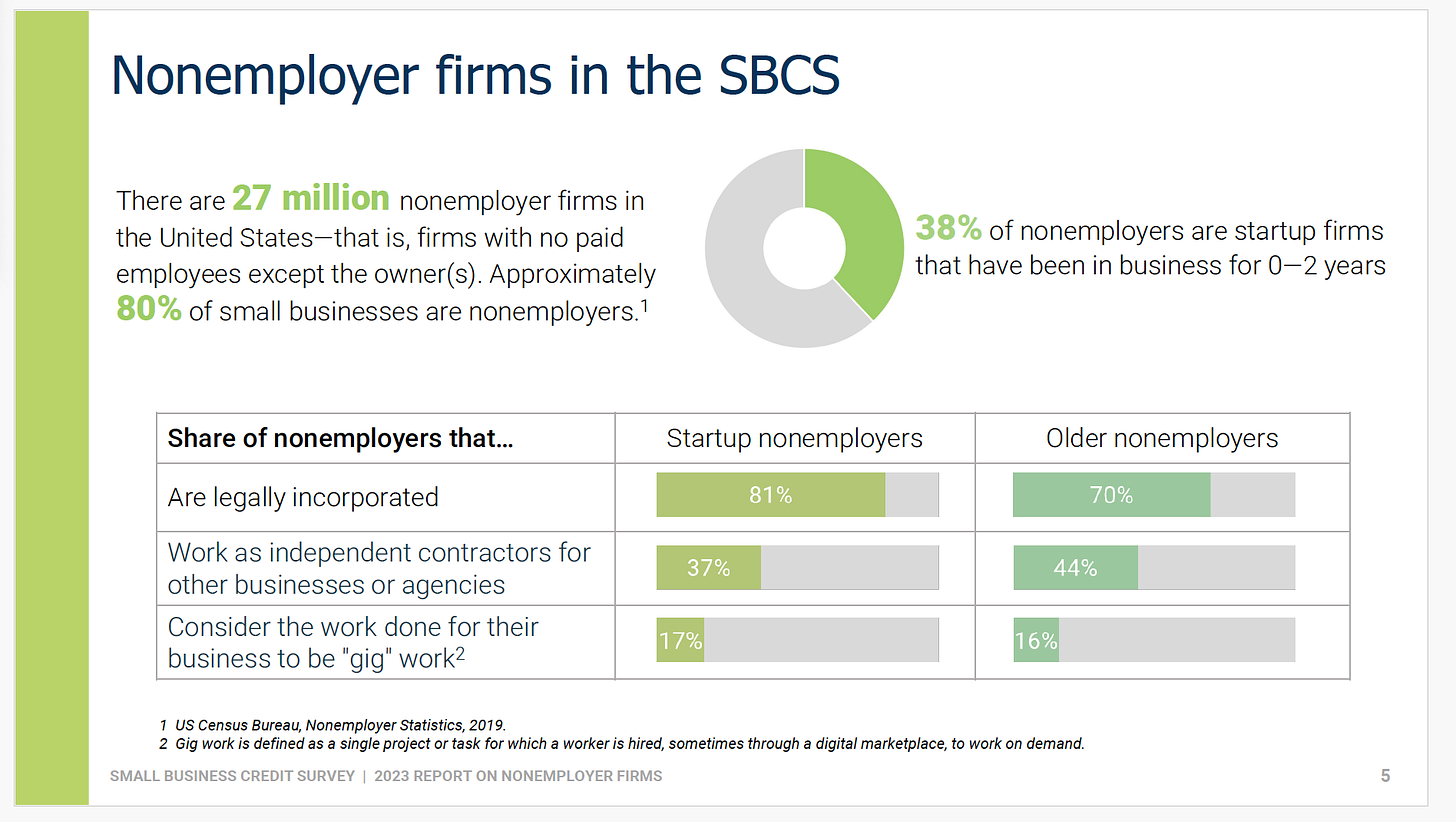

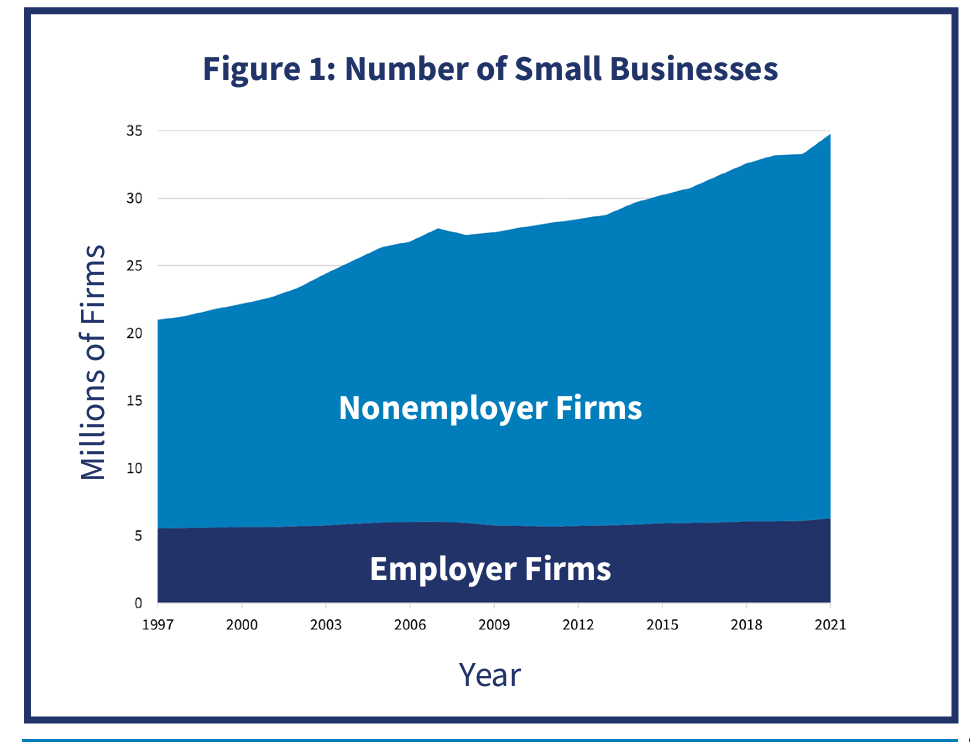

That’s because most of America’s small businesses don’t have a single employee. We’re one-person enterprises. Ours are what the government calls “nonemployer firms,” which comprise more than 80% of all small businesses in the country:

These nonemployer firms come in different shapes and sizes. They are sometimes broken down in data as independent contractors, gig workers and solo businesses incorporated as things like LLCs or S-Corps:

Instead of having storefronts on Main Street, many of America’s small businesses are run out of home offices on Maple Street or Elm Street with a laptop computer and a smartphone.

It’s a way of earning a living, or doing a side hustle, that quite a lot of Americans are embracing—especially since the pandemic taught us all the importance of reclaiming a good work-life balance.

According to the U.S. Chamber of Commerce:

“Entrepreneurship is booming in the United States. Over the last few years, the number of applications filed to start new businesses has surged. Application numbers doubled in 2020 compared to previous years, and this trend has continued, with over 5 million new business applications filed annually since then. As of April 2024, 1.75 million applications have already been filed this year.”

Are any of these small businesses being started with $5,000 or less?

You can bet your bottom dollar that they are.

Costs to Start a Small Business

As with just about everything in life, you can spend a little or a lot of money doing pretty much anything. That includes starting a small business.

If your small business is in a field such as freelance writing and editing, graphic design, social media consulting, or any other among myriad fields that require little more than a computer and a smartphone, then you can absolutely get up and running for $5,000 or less.

The U.S. Small Business Administration even has an online form you can fill out for free, to figure out how to do it.

I’ve had my own business as a freelance writer and editor for 20 years now, so I have learned what is essential to run that business. If I were thinking from the perspective of a startup about what I would absolutely need—not necessarily want, but need—to get started today, the list quite honestly would be short.

Such a startup business would be run from a kitchen table at home that already has access to Wi-Fi, so there would be no extra money required for an office, increased utilities and the like.

I could use Google’s gmail for free email communications with clients, and Google Meet for free video conferencing.

In terms of cash outlay to get the business up and running, I estimated:

$1,500 for a good-quality laptop computer;

$900 for a new-model iPhone to communicate with clients;

$160 for Microsoft Word software to write and edit articles;

$115 for a do-it-yourself promotional website made with WordPress or a similar company, plus another $20 to register a domain like MyNewBusiness (.com) for a year;

$500, give or take, depending on where you live, to incorporate as an LLC;

$100 to open a business-specific checking account;

$700 for a year’s worth of accounting and invoicing software that also sets you up for tax time, from a well-known brand such as Quickbooks or Quicken.

That’s $3,995.

Unless you already own a laptop computer and phone, as one longtime freelance writer pointed out to me. Then it’s only $1,595 to get going.

You’d still be below $5,000 if you went online and ordered a hundred business cards ($15), but personally, I’ve found I don’t usually need them in the digital age.

You also could drive down to your post office to set up a business mailbox for a year (call that $400, depending on the location for a midsize box). Or, put the remaining money aside for occasional tech support or additional software to make your services compatible for more potential clients. Maybe join a professional organization or take a class to learn more skills that might help your startup small business succeed.

With those basics plus a library card, the internet and social media, it’s possible to figure out just about anything as you start a freelance writing and editing business.

And, yes, depending on your situation, you may also need to include monthly costs for a vehicle or health insurance—but those are not necessarily required startup expenses. The type of services you offer may not require you to drive anywhere. For health insurance, if you already have a traditional job, or a parent or spouse covering that expense, then you don’t have to factor it into your startup costs.

None of this is a secret that only I somehow magically possess. Here’s what some other folks had to say this past weekend about whether it’s possible to start a small business with $5,000 or less:

Invisible Entrepreneurs

All of this is evidence of one big reason that policymaking about independent contractors so often goes sideways: More than a few lawmakers do not think of us as small-business owners, let alone understand how our small businesses get started and keep going.

This problem is evident in Vice President Harris’ interview, but it’s certainly not limited to her, or to the Democratic Party for that matter. Earlier this year, Republicans couldn’t muster enough votes from their own side for a joint resolution that would have protected independent contractors from freelance busting, even though they did manage to find the votes—joining with some Democrats, even—to try and protect franchise owners.

Quite the double standard there in Congress about what is considered a real business worth protecting.

Widening the scope even further, this problem is not even limited to the United States. Earlier this year, a report came out in Canada about what the researchers called “invisible entrepreneurs.” It concluded:

“Building a truly inclusive economy requires robust support for self-employment, both within communities and through policy initiatives.”

That word—inclusive—gets tossed around by a lot of politicians these days, too. Often, they are the same politicians who support legislation and regulatory efforts that threaten or outright destroy the small businesses of independent contractors.

The Canadian report points out that quite a lot of women and people of color are able to find success in these types of small businesses. The same is true here in the United States, where women own more than 41% and minorities own nearly 37% of nonemployer firms. All around the world, about a third of women are self-employed, typically with home-based, small-scale businesses, and often in places where they face legal inequities.

All of us (yes, the self-employed men too) need lawmakers who understand how these businesses get started, and what we need to continue thriving—especially since nonemployer businesses now contribute more than $1 trillion to the U.S. economy.

A fair bit of that trillion bucks comes from small businesses that were started with $5,000 or less.

Know it. And vote for lawmakers on both sides of the aisle who know it, too.