Truth is Truth

Freelance busting presumes to help struggling "gig workers"—but according to this new union-assisted research, they already know how to get help.

As I continue research for the book I’m writing about freelance busting, this line from the book Uberland by Alex Rosenblat keeps popping up in my mind:

“Many people who start working for Uber are prepared to run errands, but they’re not necessarily prepared to run their own business.”

I was reminded of that line, yet again, after reading through a new study about independent contractors by The New School’s Center for New York City Affairs.

Now, to be clear, this research should be taken not just with a grain of salt, but with an entire box of Morton’s kosher. The researchers surveyed about 400 people they found by working with longtime freelance-busting organizations including the Freelancers Union and the AFL-CIO (through its Consortium for Worker Education, which is the workforce development arm of the New York City Central Labor Council, AFL-CIO), along with lawmakers including U.S. Rep. Alexandrea Ocasio-Cortez, D-N.Y., whom the Democratic Socialists of America once called their “foremost socialist superstar.”

It’s a lot like having the National Rifle Association organize respondents for a gun-control survey.

Still, with that flashing-red caveat in mind, I read through the findings.

The research distinguishes between “gig workers” and “freelancers/independent contractors” in the New York City borough of Queens. The researchers say the latter group “tend to be drawn from higher-earning industries, such as consulting, finance, technology, or design and marketing.”

The researchers found that the reasons struggling “gig workers” face barriers to taking payroll jobs include a lack of education, language challenges, and being unable to navigate a job search.

My first thought, upon reading this, was to note that nobody thought to ask why “gig workers” face barriers to becoming what the researchers seem to acknowledge are legitimate freelancers/independent contractors. After all, more independents are optimistic about their futures than people in traditional payroll jobs; two-thirds of independents say freelancing makes them feel happier than traditional jobs; and the majority of independents say they earn as much as or more than they would in traditional jobs.

A big slurp of salt after that, I thought about how these new findings, even despite the inherent bias, still seem to verify what just about every other study from all kinds of sources has found, and what just about every book that is critical of “gig work” admits.

It all boils down to the same basic truths:

Most people earning income as independent contractors wish to remain self-employed. They are full-time entrepreneurs or people doing a side hustle. They have made a choice based on their health, finances and happiness.

And:

Some people feel forced into “gig work,” often described as driving for Uber or Lyft. These people can be exploitation targets. They are some combination of poor, unskilled, uneducated, unable to speak English, and undocumented immigrants.

The problem that legitimate independent contractors face—even though we comprise the vast majority of self-employed Americans—is that the latter group’s situation is driving policymaking right now.

Not just policymaking that targets the people who feel forced into “gig work,” mind you. What’s been happening in recent years is one-size-fits-all policymaking that encompasses both groups and hurts legitimate independent contractors.

As the Economic Innovation Group noted in another new report:

“Given the clear contrasts between high-end and low-end contractors’ work and arrangements, there is substantial scope for crafting better-targeted policies that protect the most vulnerable workers without limiting the options available to entrepreneurial professionals.”

Amen, hallelujah and hell yeah to that!

What we need is a total reset on the policy conversation. We need policymaking that not only recognizes both groups, but that prioritizes protecting and serving the majority who are content and even thriving, along with the minority who are not.

Notable Findings

One particular section in the research by The New School caught my eye because I haven’t seen similar findings elsewhere—and, again, because of who performed that study. When the researchers are thanking union representatives for helping to recruit respondents, it’s fair to assume the study’s results will have a pro-union, freelance-busting bias.

Even with that being the case, this research found that more than half the gig workers surveyed “had filed a labor complaint with the New York City Department of Consumer and Worker Protection (32%), the New York State Department of Labor (17%), or a union or another worker-representing group (6%) about working conditions.”

A few things stood out to me in that data.

First is that the findings dovetail with what legitimate independent contractors have been saying for years now:

There are already systems in place to address real cases of misclassification. We do not need widespread independent-contractor reclassification and unionization to address real cases of misclassification.

Second is also what legitimate independent contractors have been saying for years:

It’s not hard to access protective systems. There’s no way that 49% of people contacted official agencies by accident—in fact, the researchers state that respondents did so even when they feared retaliation for reporting violations. People having a real problem could figure out what to do, and they did it.

Third is also what legitimate independent contractors have been saying to anybody who will listen:

Unionists should not be driving independent-contractor policymaking. Almost nobody is asking for their help—certainly not legitimately self-employed Americans, and, according to this union-assisted research, at best only 6% of people who think they’ve been misclassified.

Again, this research was done by researchers who openly promote freelance-busting policies that inject employee-style, union-backed layers of bureaucracy into business relationships that have long been the sole purview of independent contractors, our clients and the courts.

Even so, parts of this research confirmed what legitimate independent contractors have been saying all along.

Truth, once again, is truth.

First, Do No Harm

Freelance-busting policies do not prevent lawbreaking companies from, well, breaking the law. Enforcing our laws addresses those problems.

Rewriting the definition of a legitimate independent contractor in ways that make it impossible for most people to choose self-employment has nothing to do with enforcing the law. It’s plain and simple freelance busting.

What’s worst about the freelance-busting approach is that it doesn’t help most of the people who actually need help. Instead, its primary effect is to destroy the income and chosen careers of people who wish to remain self-employed—the majority of independent contractors.

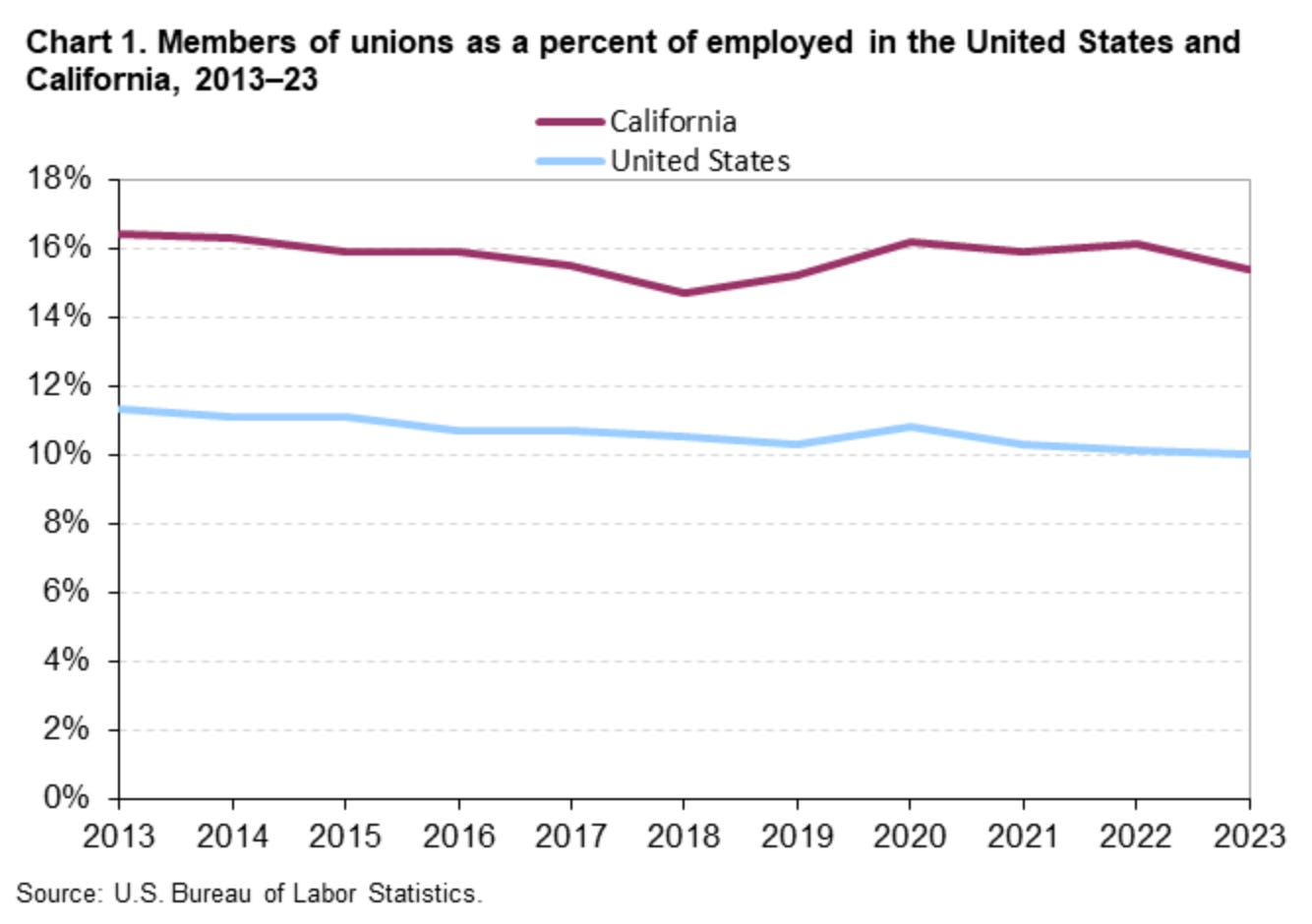

The best example we have of this reality is California’s Assembly Bill 5, which rewrote that state’s definition of an independent contractor. Lawmakers including Governor Gavin Newsom claimed that AB5 would help to reduce misclassification and create pathways to joining unions after the law went into effect in January 2020.

Didn’t happen, according to the U.S. Bureau of Labor Statistics:

Meanwhile, legitimate independent contractors said from the start in California that this freelance-busting law would hurt them. Earlier this year, the Mercatus Center released an analysis that proves the independent contractors were correct all along.

Members of the freelance-busting brigade can create as many studies as they want. They can publish as many books as they like. Unionists frustrated by their own all-time-low membership ranks can keep hollering about Uber and Lyft as a smokescreen to try and unionize the majority of Americans who simply don’t want to join unions.

It’s been years now of legitimate independent contractors being under attack. There are good reasons that freelance-busting policies consistently face widespread pushback from Americans of every gender, race, age and political affiliation.

Freelance busting isn’t about helping the people who actually need help. It’s about hurting the people who choose self-employment.

Truth is, once again, truth.

Super article. Thanks.

One excuse used by nearly everyone who opposes us drives me crazy--that we have no protections from lousy clients, unlike employees who, they claim, have many. That's bull. We have contract, business and intellectual property law. Generally, complaints based on these laws work faster than employee law because they rely on the threat of lawsuits, whereas employee law relies on the threat of bureaucracies! In my experience, recalcitrant clients and their attorneys are generally eager to avoid being sued, whereas they're immune to bureaucrats' warnings.

Thank you so much for your tireless efforts to keep us WILLING Independent Professionals out of the gaping maw of the government/union!